-

The Transparency Debate: Corporate Secrecy vs. Corporate Publicity

In recent years, the global conversation about corporate secrecy has intensified, driven by data leaks like the Panama Papers and ongoing efforts to expose financial misconduct. At the heart of this debate lies the question: Should information about corporate ownership and finances be made public, or is privacy a fundamental right that needs protection? Advocates of transparency argue for public registers of Ultimate Beneficial Ownership (UBO) as a solution to financial crimes, while critics point to their limitations and unintended consequences. This blog explores these conflicting views and their implications for businesses and society.

The Case for Corporate Publicity

Supporters of transparency, including a recent article by the Financial Times, argue that corporate secrecy enables harmful activities such as tax evasion, money laundering, and corruption. They see public UBO registers as a vital tool to combat these issues. By making information about the true owners of companies easily accessible, transparency advocates believe it will:

- Deter Illicit Activities: Publicity can discourage criminals from exploiting shell companies for illegal purposes.

- Empower Civil Society: Journalists, NGOs, and watchdogs can investigate and hold entities accountable.

- Enhance Public Trust: Open access to corporate data builds confidence in the integrity of financial systems.

For these advocates, transparency is not just about curbing criminal behavior but also about fostering a culture of accountability. The argument often appeals to the principle of fairness: legitimate businesses that pay their taxes and follow the rules should not have to compete with shadowy entities exploiting loopholes.

Criticism of Public Registers

On the other side, critics highlight the flaws and risks of public UBO registers, questioning their effectiveness and fairness. Martin Kenney, in his critique of public registers, points out that they often fail to achieve their intended goals due to poor implementation and lack of verification. Key concerns include:

- Inaccuracy and Abuse: Public registers may include false or misleading information. For example, the UK’s Companies House has been criticized for allowing unverifiable or fraudulent data to be submitted, rendering the register unreliable.

- Breach of Privacy: Critics argue that privacy is a fundamental human right, not conditional on having “nothing to hide.” They compare publicizing corporate ownership to making private medical records public—an unnecessary intrusion unless there is a clear, justified need.

- Unintended Consequences: Research suggests that public registers may not deter illicit actors, who can find alternative ways to hide assets. Instead, these registers might discourage compliance or push criminal behavior into less regulated jurisdictions.

Kenney and others propose an alternative: controlled-access registers. These systems, like those used in the British Virgin Islands (BVI), restrict access to authorized entities such as law enforcement or financial regulators. They argue that controlled registers strike a better balance between transparency and privacy, ensuring data accuracy without risking public misuse or abuse.

The Ethical Dilemma: Privacy vs. Public Interest

A recurring theme in this debate is the tension between the right to privacy and the need for public oversight. Proponents of transparency often dismiss privacy concerns with the “if-you-have-nothing-to-hide” argument, claiming that secrecy primarily benefits those engaged in wrongdoing. However, critics counter that privacy is a universal right, not a privilege to be earned. They warn that eroding privacy in the name of transparency could set a dangerous precedent, leading to broader infringements on individual freedoms.

For example, critics argue that the publication of leaked data, like the Panama Papers, often involves exposing private information about individuals who have committed no crimes. Such leaks can tarnish reputations unfairly and do little to advance the cause of justice.

Effectiveness: Does Transparency Work?

The effectiveness of transparency measures is another contentious issue. Advocates point to anecdotal successes—cases where public access to ownership data has exposed corruption or tax evasion. However, critics argue that these successes are exceptions rather than the rule. A study by Harald Amberger, Jaron Wilde, and Yuchen Wu found that after the EU implemented public ownership registers, illicit actors did not significantly alter their behavior. Instead, they were less likely to comply with transparency regulations, suggesting that public registers might not be as effective as hoped.

This raises a critical question: Are we investing in the right tools to combat financial crime, or are we creating a false sense of security?

Political and Economic Implications

he debate over corporate transparency also has significant political and economic dimensions. Advocates argue that transparency strengthens financial systems by reducing corruption and leveling the playing field for legitimate businesses. Critics, however, warn of potential economic downsides, particularly for jurisdictions that rely on financial secrecy to attract investment. They contend that poorly designed transparency measures could drive businesses to less regulated markets, harming economies without achieving meaningful reform.

Moreover, the implementation of public UBO registers often reflects political agendas. Some critics see the push for transparency as a way for developed countries to impose their standards on smaller jurisdictions, while failing to address their own shortcomings in financial regulation. For example, the United States has been criticized for allowing significant financial secrecy within its borders, even as it pressures other countries to adopt transparency measures.

The CJEU Ruling on Beneficial Ownership Registers

A significant development in this debate occurred on November 22, 2022, when the Court of Justice of the European Union (CJEU) ruled that the provision of the EU’s Anti-Money Laundering Directive, which required Member States to ensure that information on the beneficial ownership of companies is accessible to the general public, was invalid. The court found that such public access constituted a serious interference with the fundamental rights to respect for private life and the protection of personal data.

This ruling has profound implications:

- Reevaluation of Transparency Measures: EU Member States are now compelled to reassess their approaches to balancing transparency with privacy rights. The decision underscores the necessity of protecting personal data, even in the pursuit of combating financial crimes.

- Impact on Existing Registers: Countries with public UBO registers must modify their systems to comply with the ruling, potentially limiting access to authorized entities like law enforcement agencies rather than the general public.

- Broader Legal Precedents: The judgment sets a precedent emphasizing that measures aimed at transparency must not disproportionately infringe upon fundamental rights, influencing future legislation and policies within the EU and possibly beyond.

Finding a Middle Ground

While the debate remains polarized, there is growing recognition that neither extreme offers a perfect solution. Public registers have clear limitations, but total secrecy is equally problematic. A potential middle ground might involve:

- Enhanced Verification: Ensuring that data in public or controlled-access registers is accurate and trustworthy.

- Targeted Transparency: Balancing privacy and public interest by restricting access to sensitive data, except in cases of clear legal or regulatory need.

- International Cooperation: Addressing financial crimes requires coordinated action across jurisdictions, with a focus on harmonizing standards and closing loopholes.

Conclusion

The debate over corporate secrecy and publicity highlights a fundamental tension between privacy and accountability. While transparency advocates see public UBO registers as a powerful tool against financial crime, critics argue that such measures often fail in practice and come at the expense of individual rights. The CJEU’s ruling adds a legal dimension to this debate, emphasizing the need to protect fundamental rights while pursuing greater transparency and accountability in the fight against financial crime. It highlights the importance of crafting policies that balance public interest with individual privacy, ensuring that measures to enhance financial system integrity do not come at the cost of essential freedoms.

-

The Evolution of the Diamond Industry: Key Updates and the Role of Blockchain Technology in Traceability

The diamond industry is a dynamic ecosystem undergoing significant transformation due to geopolitical pressures, shifting consumer preferences, and technological advancements. As of 2024, developments in this sector have highlighted both challenges and opportunities. Here’s a deep dive into the most recent updates, with a focus on the increasingly pivotal role of blockchain technology in diamond traceability.

The Impact of EU Sanctions on Russian Diamonds

The European Union’s sanctions on Russian diamonds, effective from January 1, 2024, have reshaped the global diamond market. These sanctions, part of a broader strategy to limit Russia’s economic influence amidst geopolitical tensions, specifically target Alrosa, the world’s largest diamond producer.

This move has had a ripple effect across the industry:

- Production Cuts: Alrosa has announced plans to reduce production and its workforce by 10% in 2025 due to the sanctions and declining global diamond prices.

- Market Realignment: European jewelers are now turning to alternative suppliers, such as those in Canada and Africa, which adhere to stricter ethical sourcing standards.

- Consumer Implications: The reduced availability of natural diamonds in European markets has driven a rise in prices for certified conflict-free stones.

The sanctions underscore the growing importance of ethical sourcing, transparency, and the need for robust verification systems to ensure compliance.

Market Dynamics: Falling Prices and Industry Struggles

The global diamond market has faced turbulence, with a notable downturn in prices for natural diamonds. This trend is fueled by several factors:

- Decreased Consumer Demand: Economic uncertainties and changing buying behaviors have dampened demand for luxury items.

- Surge in Lab-Grown Diamonds: Lab-created diamonds now account for 20% of global diamond sales. Their affordability and ethical appeal have disrupted the traditional market but also led to oversupply, causing prices to drop significantly.

- Factory Closures in Key Hubs: Regions like Surat, India, have faced economic strain, with many diamond-polishing units shutting down. Thousands of workers have lost their jobs, further highlighting the challenges of over-reliance on specific markets.

The Blockchain Revolution in Diamond Traceability

In an industry grappling with transparency issues, blockchain technology has emerged as a game-changer. This decentralized, immutable ledger system is redefining how diamonds are tracked from mine to market. Here’s how:

- Improved Traceability: Blockchain solutions like De Beers’ Tracr platform have made it possible to verify the entire journey of a diamond. Each step, from mining to retail, is recorded on the blockchain, ensuring ethical sourcing.

- Combating Fraud: By providing tamper-proof records, blockchain reduces the risk of fraud, smuggling, and the circulation of conflict diamonds.

- Enhancing Consumer Confidence: Transparency initiatives backed by blockchain allow consumers to access detailed histories of their purchases, including the origin, cutting, and certification process of the diamonds they buy.

Recent Developments in Blockchain Integration

In 2024, blockchain adoption has reached new heights within the diamond industry:

- Partnerships and Collaborations: Major players like De Beers, Signet Jewelers, and Tiffany & Co. are expanding their blockchain initiatives to include smaller suppliers and retailers, ensuring a more inclusive network.

- Regulatory Backing: Governments in key diamond-producing countries, such as Botswana and Namibia, are endorsing blockchain systems as part of their efforts to combat illegal mining and export practices.

- Wider Adoption: Even smaller, independent jewelers are starting to adopt blockchain-based traceability systems to stay competitive and meet consumer demand for ethical practices.

The integration of blockchain not only helps in compliance with regulations, such as the EU’s sanctions but also positions the industry for long-term sustainability.

Changing Consumer Preferences: A Push for Ethical and Unique Gemstones

Consumer behavior is evolving, with buyers increasingly valuing ethical sourcing and personalization in their purchases. This shift has had several implications:

- Emergence of Colored Gemstones: Vibrant gems such as Paraíba tourmaline, spinels, and aquamarines are becoming more popular in luxury markets, reflecting a preference for unique and bespoke designs.

- Focus on Ethical Standards: Millennials and Gen Z consumers, who prioritize sustainability, are driving demand for conflict-free and traceable diamonds.

- Lab-Grown Diamonds as an Ethical Alternative: The affordability and eco-friendly appeal of lab-grown diamonds have made them a viable choice for a new generation of consumers.

Challenges in Enforcement and Supply Chain Management

While sanctions and technological advancements aim to improve transparency, enforcing these measures remains challenging:

- Complex Supply Chains: Diamonds often pass through multiple hands before reaching the consumer, making it difficult to track their origins.

- Illicit Trade Routes: Smuggling and fraudulent documentation continue to undermine efforts to regulate the market.

- Cost of Technology: Implementing blockchain and other traceability tools can be prohibitively expensive for smaller players in the industry.

Despite these hurdles, international collaboration and technological innovation are driving progress. Governments, industry bodies, and private enterprises are working together to standardize traceability systems and promote ethical practices.

Regulatory Efforts for Consumer Protection

In response to market disruptions, regulatory frameworks are evolving to safeguard consumers and uphold industry standards. The Indian government, for example, is introducing a new framework to enhance accountability in the diamond sector. This initiative will require stricter compliance from producers and retailers, further aligning the industry with global ethical standards.

Opportunities for Growth and Innovation

The current challenges present opportunities for the diamond industry to innovate and adapt:

- Diversifying Supply Chains: Companies are exploring new sources of natural diamonds and investing in lab-grown alternatives to meet demand.

- Technological Advancements: Beyond blockchain, artificial intelligence (AI) is being used to improve grading accuracy and predict market trends.

- Sustainability Initiatives: Efforts to reduce the environmental impact of diamond mining, such as carbon-neutral operations, are gaining traction.

Conclusion: A Transforming Industry

The diamond industry of 2024 is at a crossroads, shaped by geopolitical events, evolving consumer expectations, and rapid technological advancements. While sanctions on Russian diamonds and market downturns have posed significant challenges, they have also spurred innovation and a renewed focus on ethical practices.

Blockchain technology stands out as a transformative force, offering unprecedented levels of transparency and accountability. As its adoption becomes more widespread, the diamond industry is poised to become more resilient, sustainable, and consumer-centric.

Moving forward, collaboration between stakeholders—governments, industry leaders, and consumers—will be crucial in navigating the complexities of this transformation. By embracing change and prioritizing ethics, the diamond industry can not only overcome its current challenges but also lay the foundation for a brighter, more sustainable future.

-

Navigating the Complexities of Asset Recovery: Insights from the IBA Asset Recovery Conference 2024

Photo by Alex Azabache on Pexels.com The legal world is gearing up for the highly anticipated 2nd Annual IBA Asset Recovery Conference, scheduled for December 4-6, 2024, at the stunning Riu Plaza España in Madrid, Spain. This event, presented by the IBA Asset Recovery Committee, promises to bring together global experts to tackle some of the most pressing challenges in asset recovery, from tracing assets across borders to navigating the legal intricacies of sanctions enforcement.

Here’s a detailed preview of the conference program and its significance in shaping the future of asset recovery.

Why Asset Recovery Matters

Asset recovery sits at the intersection of law, justice, and economics. Whether dealing with fraud, insolvency, or sanctions, recovering assets is often a high-stakes endeavor. For practitioners, this requires staying ahead of complex legal frameworks, international treaties, and innovative concealment techniques. The IBA Asset Recovery Committee provides a platform for professionals to exchange insights and develop best practices in this critical area.

Key Themes and Highlights of the Conference

The 2024 conference will cover diverse topics tailored for legal practitioners, policymakers, and industry experts. Let’s explore some of the program’s highlights.

1. Tackling and Conquering Defenses in Asset Recovery

Debtors are becoming increasingly creative in evading recovery efforts. This session will explore strategies for overcoming common and uncommon defenses, including:

- Misuse of restructuring plans.

- Challenges of piercing the corporate veil.

- Surpassing alter ego arguments and third-party interference.

These discussions are essential for creditors seeking robust strategies to enforce judgments against elusive debtors.

2. Spotlight on Maritime Asset Recovery

Assets tied to maritime trade, such as vessels and cargo, present unique challenges. This panel will address:

- Tracing and enforcing claims against movable property.

- Legal hurdles in establishing ownership.

- The impact of international conventions.

Given the global nature of maritime trade, this session will appeal to practitioners involved in cross-border asset tracing.

3. Diamonds and Blockchain: Innovating Asset Recovery

The diamond industry is often associated with significant asset concealment. This session will examine:

- The role of blockchain and tokenization in tracing diamonds.

- Challenges in enforcing claims against physical assets.

- Compliance with international sanctions.

With blockchain technology revolutionizing asset recovery, this session offers a glimpse into the future of enforcement mechanisms.

4. Role of Regulators and Small-Scale Fraud

Two key panels will explore:

- The interplay between regulatory frameworks and recovery strategies.

- Solutions for victims of small-scale fraud, where legal costs often outweigh potential recoveries.

These discussions aim to make asset recovery accessible to all victims, irrespective of the scale of the fraud.

Emerging Challenges: Sanctions and Cross-Border Fraud

Also, two sessions stand out for their timeliness:

- Sanctions Enforcement: The panel will analyze the implications of sanctions on enforcement, particularly in the wake of global geopolitical shifts.

- Leveraging Insolvency Tools: Experts will delve into cross-border fraud strategies, highlighting how insolvency laws can be weaponized to recover concealed assets.

These sessions are critical for practitioners navigating the evolving landscape of international law.

Notable Features and Leadership

The conference is the result of the dedicated efforts of the IBA Asset Recovery Committee and its organizing team (which includes myself), all of whom have contributed to shaping a program that addresses some of the most pressing issues in asset recovery on a global scale.

Youth Engagement: The Future of Asset Recovery

The Youth Asset Recovery Club Meeting is a standout feature of the conference, targeting the next generation of professionals. This initiative provides young lawyers with opportunities to:

- Build networks with global experts.

- Hone their skills through targeted workshops and discussions.

Eligibility criteria include membership in the IBA and fewer than 15 years of professional experience, making it an inclusive platform for aspiring leaders.

Social and Networking Opportunities

The conference goes beyond academic discussions by offering exceptional networking events:

- A welcome reception at the 360° Skybar of the Riu Plaza España.

- The prestigious conference dinner at the Casino de Madrid, providing attendees with a chance to connect in a relaxed and elegant setting.

Why Attend?

Here’s why the 2024 IBA Asset Recovery Conference is unmissable:

- Comprehensive Coverage: From maritime issues to blockchain applications, the conference addresses a wide spectrum of topics.

- Expert Insights: Gain actionable knowledge from thought leaders in asset recovery.

- Global Networking: Connect with peers and industry leaders from across the globe.

- Professional Development: Attendees can earn CPD/CLE credits and enhance their professional standing.

Conclusion

The 2nd Annual IBA Asset Recovery Conference promises to be a transformative event, offering unparalleled insights and networking opportunities. For professionals dedicated to navigating the complexities of asset recovery, this conference is an invaluable resource.

Don’t miss the chance to join the global conversation on asset recovery this December 4-6, 2024, in Madrid. Secure your spot today and become part of a leading network of experts shaping the future of this critical field. For more details, visit the IBA conference website.

-

The Shocking Case of a Spanish Police Chief and Hidden Millions in Cryptocurrencies

In a case that has shaken Spain’s National Police force to its core, a senior officer once tasked with fighting economic and financial crime has been caught at the center of a scandal involving millions of euros in cash and cryptocurrencies. This unfolding story, which reads like a crime thriller, reveals the deep vulnerabilities in law enforcement and the misuse of insider knowledge to facilitate illicit activities.

Who Is at the Center of the Scandal?

The central figure in this case is Óscar Sánchez, the chief of Madrid’s Unit of Economic and Fiscal Crime (UDEF). This unit is typically responsible for investigating crimes like money laundering, fraud, and financial irregularities. Sánchez, who was once celebrated for his work, has now been accused of being the architect of a massive embezzlement and money-laundering scheme.

Police discovered €20 million in cash hidden in Sánchez’s properties, including homes in Villalbilla (Madrid) and Denia (Alicante). As if this weren’t shocking enough, investigators have also uncovered an estimated €17 million in cryptocurrencies tied to Sánchez, bringing his total hidden fortune to around €37 million. The cryptocurrency stash, stored in accounts in Dubai, remains unrecovered due to the lack of cooperation agreements between Spain and the United Arab Emirates.

A Web of Deception and Misuse of Knowledge

Sánchez allegedly leveraged his insider knowledge to conceal his activities. Having intimate knowledge of police investigative procedures, he reportedly used advanced strategies to transfer funds to offshore tax havens, obscuring the illegal origins of his wealth. It is suspected that he utilized the same tools he was entrusted to wield against criminals, including police databases, to ensure his accomplices were not under investigation by other units.

The parallels between Sánchez’s methods and those of another recent corruption case in Spain, the “Koldo plot,” have raised additional alarms. In both instances, corrupt law enforcement officials exploited their access to sensitive information to protect their criminal operations. For example, Sánchez reportedly used police databases to anticipate potential investigations, a tactic similar to those employed by his counterparts in the Koldo case.

Why Is This Case So Significant?

The case against Sánchez highlights a stark irony: the very officer tasked with dismantling financial crime networks and combatting money laundering is now accused of being a major perpetrator of these crimes. This betrayal of public trust strikes at the heart of law enforcement integrity.

The use of cryptocurrencies further complicates the investigation. Cryptocurrencies are known for their anonymity and decentralized nature, making them an attractive tool for money launderers. In this case, Sánchez’s knowledge of modern financial crime trends likely enabled him to exploit these digital assets effectively.

Moreover, the involvement of Dubai in the case underscores the international dimensions of modern financial crime. The city is a well-known financial hub but has faced criticism for being a safe haven for illicit funds due to limited oversight and a lack of international cooperation agreements. The Spanish authorities’ inability to recover the cryptocurrency funds highlights the challenges law enforcement faces when dealing with transnational crime in the digital age.

The Reaction in Spain

The revelations about Sánchez’s activities have caused widespread outrage in Spain, not just because of the scale of the crime but because of who committed it. Sánchez’s colleagues in the National Police were reportedly shocked; his unassuming lifestyle gave no indication of the hidden millions he was allegedly hoarding. Many feel that this case has damaged the reputation of Spain’s police force, raising questions about oversight and accountability within law enforcement.

Political leaders and commentators have called for stricter measures to prevent similar cases in the future. Suggestions include enhanced monitoring of police officers in sensitive positions, greater transparency in law enforcement operations, and improved international cooperation to combat financial crimes.

Understanding Cryptocurrencies and Their Role in Crime

For readers unfamiliar with cryptocurrencies, it’s essential to understand their unique properties that make them both revolutionary and potentially dangerous. Cryptocurrencies like Bitcoin and Ethereum operate on decentralized blockchain networks, which record transactions in a way that is nearly impossible to alter. While this technology offers incredible benefits, such as transparency and security, it also provides criminals with tools to conceal their activities.

Cryptocurrency wallets are often pseudonymous, meaning they don’t display the user’s real identity. Transactions can be traced, but linking them to a specific individual requires additional information. This anonymity has made cryptocurrencies a popular choice for money laundering and other illicit activities, as seen in Sánchez’s case.

The Bigger Picture: Law Enforcement and Digital Assets

Sánchez’s use of cryptocurrencies reflects a growing trend in financial crime. As digital assets become more mainstream, criminals are finding creative ways to exploit them. This poses significant challenges for law enforcement agencies, which often lack the tools, expertise, and legal frameworks to address these crimes effectively.

International cooperation is also a critical issue. The Sánchez case highlights how gaps in global collaboration can hinder investigations. Countries like the UAE, which have limited agreements with international law enforcement, can become safe havens for illicit funds. Addressing these gaps will require a concerted effort from governments and organizations worldwide.

Lessons for the Future

This case serves as a wake-up call for law enforcement agencies, not just in Spain but globally. It underscores the importance of robust oversight mechanisms to prevent corruption within police ranks. Additionally, it highlights the urgent need for law enforcement to adapt to the evolving landscape of financial crime, particularly the rise of cryptocurrencies.

Governments must invest in training and resources to help law enforcement agencies stay ahead of these trends. Partnerships with private companies specializing in blockchain analysis, for example, could provide valuable tools for tracking and recovering illicit funds.

Conclusion

The case of Óscar Sánchez is a stark reminder of the complexities and challenges of modern financial crime. It combines elements of betrayal, innovation, and international intrigue, highlighting the dark side of technological advancement. As the investigation continues, it is hoped that lessons learned from this scandal will lead to stronger safeguards against corruption and more effective measures to combat financial crime in the digital age.

For now, Sánchez’s actions stand as a cautionary tale of how the misuse of power and knowledge can erode public trust and undermine the very institutions designed to protect society.

-

Harmonizing Insolvency Law Across the EU: A Path to Predictability and Efficiency

In an interconnected world where business transactions often transcend borders, insolvency law plays a crucial role in providing clarity and fairness during financial distress.

Yet, in the European Union (EU), the absence of harmonized insolvency frameworks creates significant challenges. Fragmented national laws lead to inefficiencies, varied recovery outcomes, and higher costs for creditors, debtors, and investors alike.

Addressing this complexity, the European Commission proposed the Directive COM(2022) 702 final (2022/0408(COD)), which seeks to align certain aspects of insolvency law across Member States.

This initiative could transform how cross-border insolvencies are managed, ensuring more predictable, equitable, and efficient outcomes.

Why Harmonization Is Necessary

The need for harmonization in EU insolvency law stems from the inherent challenges of a fragmented system.

National disparities in insolvency regulations result in different outcomes for similar cases across Member States.

These discrepancies increase procedural complexity, prolong timelines, and diminish recovery rates.

Moreover, the high costs of cross-border insolvency cases act as a deterrent to investment, raising risk premiums for businesses operating internationally.

The EU’s proposal aims to address these issues by creating common rules that promote consistency while respecting the unique legal traditions of each Member State.

By doing so, the directive hopes to minimize inefficiencies and improve creditor confidence across the single market.

Key Components of the Directive

The proposed directive introduces several transformative measures, focusing on avoidance actions, asset tracing, pre-pack proceedings, director duties, simplified winding-up for microenterprises, and enhanced creditor involvement. Let’s explore these elements in detail.

1. Avoidance Actions

Avoidance actions are pivotal in insolvency proceedings, allowing practitioners to undo transactions that occurred before insolvency and harmed the estate. The directive proposes harmonized conditions for these actions to ensure that detrimental pre-insolvency transactions can be voided uniformly across the EU. By minimizing value losses, the proposal protects the interests of creditors and ensures fair distribution of assets.

2. Asset Tracing

Efficient asset tracing is vital for insolvency practitioners, especially in cross-border cases. The directive enhances access to financial and ownership data through interconnected national and EU-wide registers. Practitioners will gain direct access to land, cadastral, mortgage, and security interest registers, among others, under equal conditions regardless of the Member State. This measure ensures that insolvency practitioners can locate and recover assets more efficiently, reducing delays and increasing recovery rates.

3. Pre-Pack Proceedings

Pre-packaged insolvency sales (pre-packs) offer a structured approach to selling a business in distress while maximizing its value. The directive introduces a harmonized framework for pre-packs, allowing businesses to be sold as going concerns during the early stages of insolvency. This ensures continuity of operations and safeguards jobs while optimizing creditor returns.

4. Director Duties

Directors of companies play a critical role in financial distress. The directive introduces civil liability provisions to encourage directors to initiate insolvency proceedings promptly when the business becomes insolvent. Timely action can prevent the deterioration of the insolvency estate and reduce creditor losses.

5. Simplified Procedures for Microenterprises

Small businesses and microenterprises often face disproportionate burdens under traditional insolvency frameworks. The directive proposes simplified winding-up procedures tailored to these entities, reducing costs and procedural complexity. This is particularly important for fostering entrepreneurship and protecting the backbone of the European economy.

6. Creditor Involvement

The directive also promotes greater involvement of creditors through mandatory committees. These committees provide a platform for creditors to participate actively in the insolvency process, ensuring transparency and improving trust in the system.

The European Insolvency Regulation (EIR) as a Foundation

The directive builds on the framework of the European Insolvency Regulation (EIR), which governs cross-border insolvency cases within the EU.

While the EIR provides rules for jurisdiction, applicable law, and recognition of insolvency proceedings, it stops short of harmonizing tracing and recovery regimes.

This limitation leaves insolvency practitioners grappling with divergent national laws when recovering assets across borders.

Under the EIR, practitioners can exercise powers in other Member States, provided no conflicting measures are in place.

However, local laws govern asset realization, often complicating cross-border cases.

The new directive aims to address these challenges by standardizing access to asset registers and clarifying rules for cross-border asset tracing.

Enhancing Transparency and Monitoring

Transparency is a cornerstone of effective insolvency proceedings.

The directive mandates the use of interconnected insolvency registers accessible via the European e-Justice Portal.

These registers streamline access to cross-border insolvency information, improving transparency for creditors, debtors, and practitioners.

Additionally, the directive introduces robust monitoring mechanisms to ensure data protection and compliance.

Central registries will log each instance of access to asset and ownership data, providing an auditable trail for oversight.

These logs will be retained for five years, balancing transparency with privacy.

Avoidance Actions: Specific Provisions

Avoidance actions under the directive are designed to address specific scenarios of creditor harm:

- Preferences (Article 6): Transactions benefiting creditors within three months of insolvency can be voided if creditors knew or should have known about the debtor’s financial distress.

- Inadequate Consideration (Article 7): Transactions lacking fair value within one year of insolvency may be voided.

- Intentional Detriment (Article 8): Acts intended to harm creditors within four years of insolvency can be voided.

The consequences of void transactions include compensation obligations for benefiting parties and liability for heirs and successors who knowingly participated in the void transaction.

Balancing National Flexibility with EU-Wide Standards

While the directive sets minimum harmonization standards, it allows Member States to apply stricter creditor protections.

This flexibility respects national legal traditions while ensuring a baseline of fairness and predictability across the EU.

For instance, Member States can establish broader avoidance rights or stricter asset tracing rules to enhance creditor recovery.

Implications for Stakeholders

The proposed directive has far-reaching implications for various stakeholders:

- Insolvency Practitioners: Gain clearer powers and tools for cross-border cases, reducing procedural hurdles.

- Creditors: Benefit from improved recovery rates and enhanced involvement in proceedings.

- Debtors: Face standardized protections while ensuring fair outcomes for creditors.

- Investors: Experience reduced risk premiums and greater confidence in cross-border investments.

Looking Ahead: Opportunities and Challenges

The harmonization of insolvency law across the EU is an ambitious but necessary endeavor.

By addressing inefficiencies and promoting transparency, the directive could significantly improve cross-border insolvency outcomes.

However, challenges remain in balancing national autonomy with EU-wide consistency.

Effective implementation will require cooperation among Member States, robust legal frameworks, and ongoing monitoring to ensure compliance.

Conclusion

The EU’s proposed directive on insolvency law represents a pivotal step toward harmonizing cross-border insolvency processes.

By introducing common rules for avoidance actions, asset tracing, and pre-pack proceedings, the directive aims to create a more predictable and efficient system.

While challenges remain, the proposal underscores the EU’s commitment to fostering a fair and transparent insolvency framework that benefits all stakeholders.

As the directive progresses, it will be critical to engage practitioners, legislators, and businesses in shaping a system that upholds the principles of fairness and efficiency in financial distress.

-

EU Directive 2024/1260 on Asset Recovery and Confiscation: Strengthening Europe’s Fight Against Economic Crime

On January 26, 2024, the European Union introduced Directive 2024/1260, a vital legislative framework aimed at improving asset recovery and confiscation across EU Member States. This directive targets the financial power of organized crime by enhancing the ability of authorities to trace, freeze, and confiscate proceeds of criminal activity. By addressing key gaps in the current legal framework, this directive represents a major step forward in tackling economic crime, including money laundering, corruption, terrorism financing, and the violation of EU sanctions.

In this blog post, we will explore the key provisions of the EU Directive 2024/1260 and its implications for businesses, law enforcement, and the broader fight against organized crime in Europe.

1. Strengthening Asset Recovery Mechanisms

One of the core objectives of the directive is to make it easier for authorities to recover assets linked to criminal activities. This includes enhancing the legal frameworks surrounding the tracing, freezing, and confiscation of illicit assets. The EU recognizes that criminal organizations thrive on their ability to hide and move assets across borders, often using sophisticated methods to evade detection.

Directive 2024/1260 introduces standardized procedures across Member States to streamline asset recovery operations. This reduces the complexity of cross-border investigations and confiscation efforts, ensuring that national authorities can more effectively target criminals who attempt to move illicit proceeds across EU borders.

By setting minimum standards for asset recovery, the directive aims to close loopholes that previously allowed criminals to exploit discrepancies between national legal systems. For instance, if one Member State had weaker confiscation laws, it would serve as a safe haven for criminal proceeds. The new directive creates a level playing field across the EU, limiting the opportunities for criminals to take advantage of such disparities.

2. Expanding the Scope of Confiscation

Another significant element of the directive is its expansion of the scope of confiscation. In the past, many national systems only allowed for the confiscation of assets directly linked to a crime. This narrow scope often hindered authorities from targeting the full breadth of a criminal organization’s financial base. Criminals could easily transfer assets to third parties or hide their wealth through complex legal structures, such as shell companies or trusts.

Directive 2024/1260 broadens the scope of confiscation by including assets that have been transferred to third parties or legal entities. This is particularly important in cases where criminal assets have been placed under the control of relatives, associates, or corporate entities that may appear legitimate on the surface. The directive ensures that authorities can pursue the recovery of these assets, even if they have been moved to seemingly innocent third parties.

Furthermore, the directive introduces a provision for extended confiscation, allowing authorities to seize assets not directly linked to a specific crime but suspected of being derived from other criminal activities. This is crucial in cases where criminals cannot provide a legitimate explanation for their wealth, enabling law enforcement agencies to target illicit enrichment more effectively.

3. Legal Persons and Economic Crime

An important aspect of the directive is its focus on economic crime and the role of legal persons, such as corporations, in facilitating criminal activities. Organized crime syndicates and other criminals often use legal entities to launder money, hide the origin of illicit assets, and move funds across borders. These legal entities, if left unchecked, become instruments for financial crime, undermining the integrity of the EU’s financial system.

Directive 2024/1260 directly addresses this issue by making it easier to confiscate assets owned or controlled by legal persons. It emphasizes that legal persons involved in criminal activities will face the same scrutiny as individuals, making it harder for criminals to shield themselves behind corporate structures. The directive also outlines the conditions under which legal entities can be held liable for crimes committed on their behalf or in their interest.

By targeting both individuals and legal persons, the directive strikes at the heart of economic crime, ensuring that the full extent of criminal networks—whether individuals or corporate entities—can be held accountable for their actions.

4. Cross-Border Cooperation and Coordination

Effective asset recovery often requires cross-border cooperation, especially when criminal networks operate transnationally. Directive 2024/1260 recognizes the need for enhanced collaboration between Member States and introduces measures to improve the exchange of information and coordination of asset recovery efforts.

One key feature of the directive is the creation of Asset Recovery Offices (AROs) in each Member State, tasked with tracing and identifying assets that can be frozen or confiscated. These offices will cooperate closely with Europol and Eurojust, two EU agencies that play a critical role in combating cross-border crime. By fostering greater cooperation between these bodies, the EU aims to make it more difficult for criminals to hide assets by moving them across different jurisdictions.

The directive also encourages Member States to work together in freezing and confiscating assets linked to criminal activities in other EU countries. This cross-border collaboration is essential in a single market like the EU, where goods, services, and capital can move freely. The new rules ensure that the same level of scrutiny is applied to criminal assets, regardless of where they are located within the Union.

5. Addressing the Violations of EU Sanctions

The directive also plays a vital role in the enforcement of EU sanctions, particularly those related to global security threats. Sanctions are a key tool in the EU’s foreign policy, used to deter and punish entities that violate international law or pose a threat to peace and security. However, sanctions are often evaded through financial maneuvers that make it difficult to trace and freeze the assets of sanctioned individuals or organizations.

Directive 2024/1260 enhances the EU’s ability to enforce sanctions by strengthening the mechanisms for asset tracing and freezing. It ensures that sanctioned individuals and entities cannot move their assets freely within the EU or use complex legal structures to evade the consequences of their actions. By closing these loopholes, the directive supports the EU’s broader foreign policy goals, ensuring that sanctions are an effective tool for maintaining global security.

Conclusion

The EU Directive 2024/1260 marks a major step forward in the fight against organized crime, economic crime, and the violation of EU sanctions. By strengthening asset recovery mechanisms, expanding the scope of confiscation, and enhancing cross-border cooperation, the directive provides a robust framework for tackling the financial foundations of criminal networks. As the EU continues to prioritize sustainability and the rule of law, this directive reinforces its commitment to protecting the integrity of its financial system and ensuring that crime does not pay.

For more detailed information, you can access the full text of the directive here.

-

When Will the Russian Sanctions End? Key Factors and Scenarios for the Future

Since Russia’s invasion of Ukraine in 2022, a comprehensive and far-reaching sanctions regime has been imposed by Western governments, aiming to weaken Russia’s economy and political elite. Over two years later, these sanctions remain firmly in place.

The upcoming U.S. election will play a pivotal role in determining whether the current sanctions regime continues, is modified, or even lifted. But beyond domestic politics, several global factors must align before we see any significant movement towards the end of Russian sanctions. In this blog entry, we will explore what might need to happen for the sanctions regime to end, including the potential outcomes of the ongoing conflict in Ukraine, shifts in global diplomacy, and the role of international economic interests.

1. The Role of the Ukraine Conflict

At the core of the sanctions regime against Russia is its ongoing military actions in Ukraine. The most immediate condition for the lifting or reduction of sanctions is a resolution to the conflict that is acceptable to both Ukraine and the international community. This could take the form of a formal peace agreement, a ceasefire, or other diplomatic solutions that indicate a significant de-escalation of hostilities.

However, the exact terms of such an agreement are critical. Western nations, led by the U.S. and European Union, are unlikely to lift sanctions without assurances that Russia respects Ukraine’s sovereignty and withdraws from occupied territories. The annexation of Crimea in 2014 remains a contentious issue, and any lasting peace will likely require addressing these territorial disputes, which complicates the path toward lifting sanctions.

Additionally, Ukraine and its Western allies have pushed for reparations and war crime accountability. If Russia agrees to such demands, the sanctions could be gradually eased. Conversely, continued aggression or unwillingness to compromise could solidify sanctions for the long term.

2. A Change in Russia’s Leadership or Political Landscape

Another key factor that could lead to the lifting of sanctions is a significant change in Russia’s political leadership or internal policies. The current regime, under President Vladimir Putin, has shown no signs of backing down, and the sanctions are aimed largely at crippling the financial networks supporting Putin’s government and his inner circle.

A leadership change could come through several possible scenarios:

- Internal political shifts: If domestic unrest or political opposition gains enough momentum within Russia to force changes in leadership, this could result in a more diplomatic stance toward the West and the potential for peace negotiations.

- Regime collapse: A more drastic and unlikely scenario could involve the collapse of Putin’s regime, either due to internal dissent, economic hardship caused by sanctions, or international isolation.

While regime change does not guarantee a shift in foreign policy, a new government more willing to negotiate with the West could lead to a recalibration of relations and a pathway to lifting sanctions. However, any new leadership would likely have to demonstrate a clear break from the policies that led to the sanctions in the first place.

3. Global Economic and Political Realignments

Geopolitical shifts beyond Russia’s borders could also influence the future of sanctions. Changes in leadership in Western countries or a realignment of international priorities might lead to different stances on the sanctions regime. For instance, if the political landscape in key sanctioning nations like the U.S., UK, or EU shifts toward leaders or governments that prioritize de-escalation over punitive measures, the sanctions could be eased as part of a broader diplomatic strategy.

Moreover, international organizations such as the United Nations or regional blocs might play a role in brokering agreements that could influence the sanctions landscape. If there is a global push for diplomatic solutions to address not just the Ukraine conflict but wider geopolitical tensions involving Russia, a more unified approach could lead to sanctions being lifted.

The global economic environment may also play a part. As the impact of sanctions ripples through global energy markets and economies, certain countries may seek to negotiate with Russia to stabilize these markets, which could lead to selective easing of sanctions in areas such as energy or trade.

4. Russia’s Economic Adaptation

Interestingly, the Russian economy has shown some resilience in the face of Western sanctions, as Russia adapts to new economic realities by strengthening its relationships with non-Western nations, including China, India, and other Global South countries. If Russia continues to develop these economic alliances, it may reach a point where the impact of Western sanctions is significantly diminished. In this scenario, the leverage that sanctions provide could erode, reducing their effectiveness as a tool of international pressure.

If Russia manages to build a parallel economic system that bypasses Western financial networks and trade routes, the motivation for maintaining the current sanctions regime might weaken, especially if they no longer achieve their intended economic or political objectives.

5. Humanitarian Considerations

The humanitarian toll of sanctions cannot be ignored, particularly if they begin to disproportionately affect ordinary citizens rather than the intended targets within Russia’s political and business elite. If sanctions contribute to a severe humanitarian crisis in Russia, there may be increasing international pressure to ease sanctions for humanitarian reasons, such as lifting restrictions on food, medicine, and other essential goods.

International bodies like the United Nations, human rights organizations, and non-governmental organizations could advocate for a partial rollback of sanctions if they argue that the suffering of civilians outweighs the political benefits of maintaining the punitive measures. This could lead to selective lifting of sanctions, even if the broader geopolitical issues remain unresolved.

6. Incremental Lifting of Sanctions

It is also possible that the sanctions regime will not end abruptly but will be lifted incrementally based on specific conditions being met by Russia. For example, Western governments may choose to ease certain sanctions related to trade or energy exports in exchange for partial troop withdrawals or other steps toward de-escalation in Ukraine. This kind of phased approach could serve as a diplomatic tool, encouraging compliance with international demands while keeping pressure on Russia to continue its retreat from aggressive policies.

Such an approach would allow for flexibility in international relations, with the option to reimpose sanctions if Russia fails to meet its obligations. However, it also presents the risk of “sanctions fatigue,” where countries become less inclined to maintain punitive measures over extended periods.

Conclusion

While the end of the Russian sanctions regime is contingent on several factors, the reality is that there is no quick resolution in sight. As long as the Ukraine conflict persists, and Russia’s leadership remains committed to its current policies, the sanctions are likely to remain a critical component of the West’s strategy. The potential for easing or lifting sanctions will depend on diplomatic breakthroughs, changes in Russia’s political landscape, or shifts in global economic and geopolitical priorities.

For now, the international community will continue to monitor developments closely, balancing the need to maintain pressure on Russia with the recognition that sanctions are only one part of a broader strategy to resolve a deeply complex conflict.

-

Sanctions and Politically Exposed Persons (PEPs) in 2024

Sanctions have long been a powerful tool in international diplomacy, used to pressure individuals, organizations, and countries involved in illicit activities, human rights abuses, or corruption. In 2024, the enforcement of sanctions has intensified, with a particular focus on Politically Exposed Persons (PEPs) and asset tracing. The global sanctions against Russia, following its invasion of Ukraine, have drawn particular attention as governments work to track and recover the assets of Russian oligarchs and officials. However, while many sanctions are effectively applied to individuals closely tied to the Kremlin, there have also been significant cases of wrongful targeting and misidentified assets, illustrating the challenges and complexities of the asset recovery process.

Understanding Sanctions and PEPs: The Basics

Sanctions are restrictive measures imposed by governments or international bodies aimed at coercing or penalizing individuals, companies, or nations that engage in illegal activities or pose a threat to international stability. These sanctions can range from asset freezes and travel bans to trade embargoes. Politically Exposed Persons (PEPs) are individuals who hold high-level public roles or are associated with those in power, such as senior politicians, military leaders, or oligarchs. Due to their positions, PEPs are often more vulnerable to corruption and financial misconduct, making them key targets in asset tracing and recovery.

The Russian sanctions, particularly, have underscored the importance of these measures in modern geopolitics. Since 2022, the U.S., EU, UK, and other Western governments have levied sweeping sanctions against Russian individuals and entities, aiming to disrupt the financial networks supporting the Russian government. This includes freezing billions in assets held by Russian PEPs abroad. However, the targeting of assets is not always straightforward, and as the enforcement of sanctions has ramped up, issues of wrongful targeting and the misidentification of assets have arisen.

The Impact of Russian Sanctions on Asset Tracing and Recovery

The sanctions against Russia have created significant challenges in the world of asset tracing and recovery, particularly in uncovering assets linked to Russian oligarchs and government officials. The complexities of these cases stem from the sophisticated methods used to hide wealth and the transnational nature of these networks. But an emerging issue is the wrongful inclusion of certain individuals and the misidentification of assets as belonging to sanctioned individuals.

1. Complex Asset Structures and the Wrongful Linking of Assets

Russian oligarchs and PEPs often use sophisticated legal and financial structures to conceal their assets, including offshore accounts, shell companies, and proxy ownership. However, this can sometimes lead to assets being wrongly linked to sanctioned individuals. In some cases, assets owned by legitimate businesses or individuals are mistakenly frozen due to an indirect connection to a sanctioned person.

For example, complex ownership structures may cause authorities to freeze assets of individuals who share business interests with sanctioned figures but have no direct involvement in illicit activities. This has happened in cases where joint ventures or partnerships—some of which were initiated long before sanctions were imposed—were misinterpreted as attempts to shield assets from recovery efforts.

2. Shifting Assets to Friendly Jurisdictions and Legal Challenges

In response to sanctions, many Russian PEPs have moved their wealth to jurisdictions that are either neutral or supportive of Russia, such as the United Arab Emirates or Turkey. However, some assets have been mistakenly linked to sanctioned individuals simply because they are in these jurisdictions, leading to wrongful asset freezes. Asset recovery professionals now face the challenge of distinguishing legitimate holdings from those belonging to sanctioned figures.

Another issue arises when innocent individuals are mistakenly included in sanctions lists, which can severely damage their reputations and financial standing. As a result, several Russian businesspeople and investors have challenged their inclusion in sanctions lists in court. For example, some individuals have been able to prove they had no direct ties to the Russian government or activities related to the Ukraine conflict, leading to their removal from sanctions lists.

3. Cases of Wrongful Targeting: Individuals Removed from Sanctions Lists

There have been notable cases of individuals who were wrongfully sanctioned and subsequently removed from sanctions lists. One prominent example is that of Roman Abramovich, the former owner of Chelsea Football Club, who has taken steps to distance himself from Russian politics and has even engaged in mediation efforts between Russia and Ukraine. Despite initial sanctions, Abramovich’s efforts led to a reassessment of his situation, and some of his assets have been unfrozen. His case highlights the nuances in determining which individuals are truly tied to a sanctioned regime and which may have been wrongfully targeted.

Another example is Mikhail Fridman, a Russian-born billionaire with substantial business interests in Europe. Fridman has long maintained that he has no close ties to the Kremlin, but he was still targeted by sanctions due to his wealth and public profile. Fridman launched legal challenges in European courts to contest his inclusion, claiming that he was wrongfully sanctioned. His case continues to be a subject of debate, as courts weigh the evidence of his political connections versus his claims of independence from the Russian government.

4. Asset Freezes and the Burden on Businesses

Another trend related to Russian sanctions is the freezing of assets belonging to businesses that operate globally but have Russian shareholders or investors. In some cases, multinational companies have had their operations disrupted because of minority stakes held by Russian PEPs or sanctioned entities. These businesses, which may be based outside Russia and have no direct involvement in Russian politics, find their assets frozen or their access to international banking severely limited.

This has led to significant legal challenges as these companies seek to differentiate themselves from the sanctioned individuals or entities connected to them. Asset tracing professionals must now navigate the intricate web of ownership to ensure that only assets truly connected to sanctioned persons are frozen, while legitimate businesses can continue their operations.

The Role of International Cooperation and Regulatory Challenges

In cases involving wrongful targeting, asset recovery professionals face the delicate task of balancing enforcement with fairness. Mistakes in identifying assets or individuals linked to sanctioned PEPs can lead to reputational damage, significant financial losses, and protracted legal battles. The use of international frameworks, such as the European Union’s updated Global Human Rights Sanctions Regime, aims to address these complexities by ensuring better due diligence before imposing sanctions.

However, the legal challenges and lengthy processes for appealing wrongful sanctions can undermine the effectiveness of these measures. For individuals and businesses, the path to being removed from sanctions lists can be long and costly. International cooperation, transparency, and due process are key to ensuring that asset tracing and recovery efforts target the right individuals while minimizing wrongful enforcements.

How Asset Recovery Professionals Are Adapting

Given the increasing complexity of sanctions enforcement, asset recovery professionals are adapting their methods to ensure accurate tracing and fair targeting. Some strategies include:

- Forensic Financial Analysis: Investigators use detailed forensic audits to trace the flow of money and establish clear connections between assets and sanctioned individuals, minimizing the risk of wrongful seizures.

- Enhanced Due Diligence: Before freezing assets, investigators conduct enhanced due diligence on individuals and companies to ensure they are correctly linked to the sanctioned regime.

- Legal Recourse for Wrongful Targeting: Lawyers specializing in sanctions-related litigation are increasingly representing clients who believe they were wrongfully included in sanctions lists, advocating for their removal and the release of frozen assets.

Conclusion

The intersection of sanctions enforcement and asset tracing has become more intricate in 2024, particularly in the context of Russian sanctions. While these measures play a critical role in pressuring regimes and individuals engaged in unlawful activities, they also come with risks of wrongful targeting. As asset recovery professionals work to trace assets linked to Russian oligarchs and PEPs, they must also contend with cases where assets are wrongfully frozen, or individuals are mistakenly sanctioned.

The evolving landscape of sanctions enforcement underscores the need for international cooperation, transparency, and the use of sophisticated investigative techniques to ensure fairness in the asset recovery process. As more cases of wrongful targeting come to light, it is crucial for legal systems and governments to adapt and refine the tools they use to combat illicit financial flows while respecting due process and individual rights.

-

Trends Spotted in 2024: The Evolving Landscape of Asset Tracing and Recovery

As global markets evolve and technology continues to advance, the methods used to hide, trace, and recover assets are also changing. In 2024, several key trends have been reshaping the asset recovery landscape, driving innovation and changing how investigators and legal professionals approach complex cases. In this blog post, we’ll explore some of the most significant trends in asset tracing and recovery this year.

1. The Continued Rise of Cryptocurrencies and Digital Assets

One of the most transformative trends in asset recovery is the growing focus on cryptocurrencies and digital assets like NFTs (non-fungible tokens). These assets are increasingly being used to hide wealth, creating new challenges for asset recovery professionals. Cryptocurrencies are decentralized, pseudonymous, and often operate across borders, making them difficult to track using traditional financial investigation methods.

To address this, asset tracing experts are now developing advanced techniques to trace digital wallets and monitor blockchain transactions. Blockchain analytics tools have emerged to help investigators track the flow of funds across decentralized networks, linking digital wallets to individuals or entities. However, the volatility and anonymity inherent to the crypto world require constant adaptation by professionals seeking to recover assets hidden in these formats.

Regulatory bodies are also stepping up efforts to govern digital assets. Governments worldwide are implementing tighter regulations on cryptocurrency exchanges, improving transparency, and facilitating the recovery of misappropriated digital assets. As regulators catch up with the rapid pace of technological innovation, asset tracing in this space is expected to become more streamlined.

2. The Importance of Cross-Border Enforcement

In an increasingly globalized world, the complexity of cross-border asset recovery is growing, and cases now frequently involve multiple legal systems, international courts, and regulatory bodies.

To successfully recover assets from multiple countries, legal professionals must navigate a maze of international treaties and varying legal frameworks. Multilateral organizations, such as the United Nations Commission on International Trade Law (UNCITRAL) and the European Union, are playing an important role in promoting cross-border collaboration. The mutual recognition of judgments, enhanced cooperation between law enforcement agencies, and a focus on the recovery of assets linked to criminal enterprises are all becoming more prominent.

Collaboration among legal professionals, forensic accountants, and investigative firms is critical in these cross-border cases. By pooling resources and expertise across jurisdictions, professionals can more effectively locate and recover hidden or misappropriated assets, no matter where they are concealed.

3. The Use of AI and Big Data in Asset Tracing

Artificial intelligence (AI) and big data are revolutionizing asset tracing and recovery. Investigators are now using advanced AI-driven tools to sift through enormous amounts of financial data, identifying patterns, anomalies, and connections that might have been overlooked using traditional methods. These tools can process vast amounts of information in a fraction of the time it would take a human investigator.

AI-powered forensic accounting, due diligence, and fraud investigations allow professionals to analyze global financial transactions, identify red flags, and trace assets across complicated networks. Moreover, predictive analytics are now being used to anticipate fraud schemes and prevent the movement of assets before they disappear.

As AI and big data technology continue to develop, we can expect even more sophisticated tools to emerge in the asset recovery space, further enhancing the efficiency and accuracy of investigations.

4. The Influence of ESG on Asset Recovery

Environmental, Social, and Governance (ESG) factors are becoming increasingly influential in corporate decision-making, and they are also starting to impact asset recovery efforts. Investors, regulators, and consumers are putting pressure on businesses to meet ethical standards, and failure to do so can lead to financial penalties, reputational damage, and asset seizures.

Companies involved in environmental violations, corruption, or other ESG-related misconduct are facing heightened scrutiny from regulators. As a result, the recovery of assets linked to such violations is becoming more common. ESG violations, such as those involving environmental degradation or labor abuses, are often financially linked to fraudulent or hidden activities, providing an additional incentive for asset tracing and recovery professionals to pursue these cases.

5. Targeting Third-Party Enablers

One of the most significant trends in asset recovery today is the growing focus on third-party enablers. These are professionals, such as lawyers, accountants, bankers, and fiduciaries, who may knowingly or unknowingly help conceal or move illicit assets. Governments and regulators are increasingly scrutinizing these enablers, and recovery efforts are now targeting the professionals who facilitate the concealment of assets.

For example, financial institutions that fail to conduct adequate due diligence or assist in moving funds can be held liable for enabling money laundering or fraud. Legal actions against these third-party enablers are on the rise, as asset recovery professionals pursue both the assets and those who helped hide them.

6. Sanctions and Politically Exposed Persons (PEPs)

Global political instability has resulted in increased sanctions on individuals and entities linked to corrupt or criminal activities, particularly in regions such as Russia, China, and the Middle East. Sanctions enforcement and asset recovery efforts are becoming more intertwined, particularly when dealing with assets linked to Politically Exposed Persons (PEPs).

Tracing and recovering assets tied to PEPs often involves navigating complex legal frameworks and dealing with sanctioned individuals. Governments are tightening their controls on assets held by sanctioned persons, which makes the asset recovery process more intricate, especially when it involves offshore accounts and shell companies.

7. The Growing Role of Insolvency in Asset Recovery

Insolvency and bankruptcy proceedings are increasingly being used as a tool for asset recovery, particularly in cases where fraudulent transfers have occurred. Creditors are becoming more aggressive in pursuing assets hidden through insolvency mechanisms, such as fraudulent conveyances and voidable transactions. By leveraging insolvency law, creditors can unwind asset transfers and recover misappropriated funds, making this an effective strategy in complex recovery cases.

8. Collaboration Between Law Firms and Investigative Firms

The complexity of modern asset recovery cases has led to closer collaboration between law firms and specialized investigative firms. These firms use deep-dive forensic investigations to locate hidden assets, particularly those shielded by shell companies, trusts, or offshore structures. Legal professionals now rely heavily on these investigative partnerships to navigate the intricacies of global asset recovery.

Conclusion

Asset tracing and recovery in 2024 is evolving rapidly, driven by technological advancements, regulatory changes, and increasing globalization. As the methods used to conceal assets become more sophisticated, the tools and strategies used to recover them must keep pace. From the rise of digital assets and AI-driven investigations to the growing importance of ESG and cross-border enforcement, professionals in this field are adapting to a dynamic and challenging landscape. The future of asset recovery will be shaped by these trends, and those who can navigate this complexity will be best positioned to succeed.

-

Rudy Kurniawan Is Back: “Dr. Conti”, from Notorious Wine Fraudster to Cult Figure?

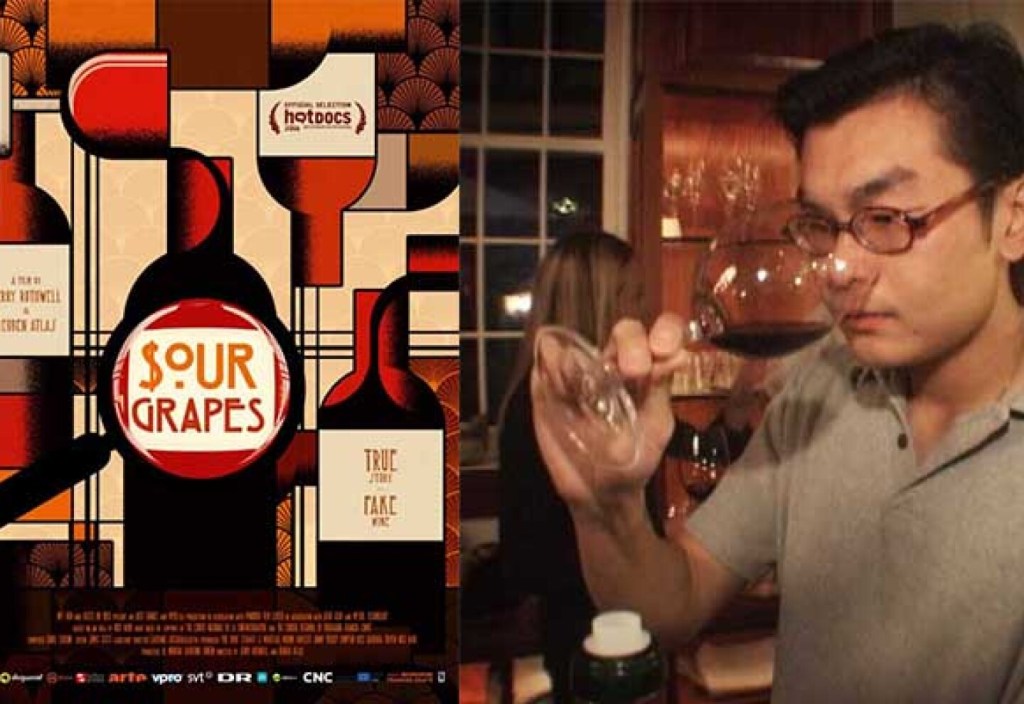

Introduction

In the annals of wine fraud, few names stir as much intrigue and controversy as Rudy Kurniawan. Once a revered name among wine collectors, Kurniawan’s descent into notoriety as a master wine counterfeiter is as dramatic as it is unprecedented. His story, which inspired the 2016 Netflix documentary “Sour Grapes” by Jerry Rothwell and Reuben Atlas, offers a fascinating look at the intricacies of wine valuation and the fine line between genius and fraud. Now, in an unexpected twist, his past notoriety has transformed into a bizarre form of cult status. This piece delves into the rise, fall, and peculiar resurgence of Rudy Kurniawan.

Early Years and Rise to Fame

Born in Indonesia in 1976, Rudy Kurniawan moved to the United States in the late 1990s. He quickly made a name for himself in the wine community with his seemingly encyclopedic knowledge of vintage wines and an uncanny ability to source rare bottles. His deep knowledge of vintage wines and ability to source rare bottles earned him the nickname “Dr. Conti,” a nod to his fondness for wines from Domaine de la Romanée-Conti, one of Burgundy’s most esteemed vineyards. This title reflected his reputation as an expert in these highly sought-after wines. His charm and expertise won him entry into the inner circles of wine collectors and connoisseurs. By the early 2000s, Kurniawan was not just a respected figure in these circles; he was a trendsetter.

The Unraveling of a Wine Con

However, Kurniawan’s meteoric rise was built on a foundation of deceit. The first cracks appeared when experts noticed inconsistencies in his offerings. The tipping point came when Kurniawan attempted to auction bottles of Clos Saint-Denis from the Domaine Ponsot, which the winemaker claimed never existed for the vintages Kurniawan was selling. This led to investigations revealing that Kurniawan was mixing cheaper wines and re-bottling them as expensive vintages in his kitchen.

Conviction and Imprisonment

In 2013, the curtain was finally pulled back, and Kurniawan’s charade came to an end. He was convicted of selling millions of dollars worth of counterfeit wines and sentenced to 10 years in prison. The FBI estimated that he sold about $30 million in fraudulent wines, though the actual figure might be much higher. His conviction sent shockwaves through the wine world, shattering the trust and authenticity that is the cornerstone of wine collecting.

Unexpected Cult Status and Current Endeavors

Fast forward to 2023, following his release from prison and subsequent deportation to Indonesia, Rudy Kurniawan has re-emerged in the wine scene, but in a role that is as controversial as it is unexpected. He is now being sought after for his expertise in creating counterfeit wines, not as a means of deceit, but as a form of entertainment and curiosity.

In a bizarre turn of events, Kurniawan’s infamy has become his selling point. He was reportedly hired to create fake versions of prestigious wines for a private event in Singapore, where guests compared his forgeries to the real bottles. Surprisingly, many preferred Kurniawan’s versions. This incident highlights a surreal facet of the wine world where the line between authenticity and artistry blurs.

Reflections on the Wine World

The story of Rudy Kurniawan is more than a tale of crime and deception. It raises fundamental questions about value, authenticity, and the perception of luxury. His ability to fool connoisseurs and experts for years challenges the notion of what makes a wine valuable—is it its taste, its rarity, or the story behind it?

Conclusion

As Kurniawan continues to create his “masterpieces,” albeit now transparently fake, he paradoxically garners a following that admires his skills and the audacity of his past actions. While some view his current activities with disdain, others see them as a form of art, further muddling the already complex relationship between authenticity and value in the wine world.

Rudy Kurniawan’s journey from a respected wine connoisseur to a convicted fraudster and now to a cult figure is a fascinating study of human psychology, luxury perception, and the fine line between genius and infamy. As he continues to navigate his notorious legacy, the wine world watches with a mix of apprehension, curiosity, and, perhaps, a hint of admiration for the audacity of his artifice.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.